preCharge News BUSINESS — Mortgage rates fell for a sixth consecutive week to the lowest level in more than two months, mortgage buyer Freddie Mac said Thursday.

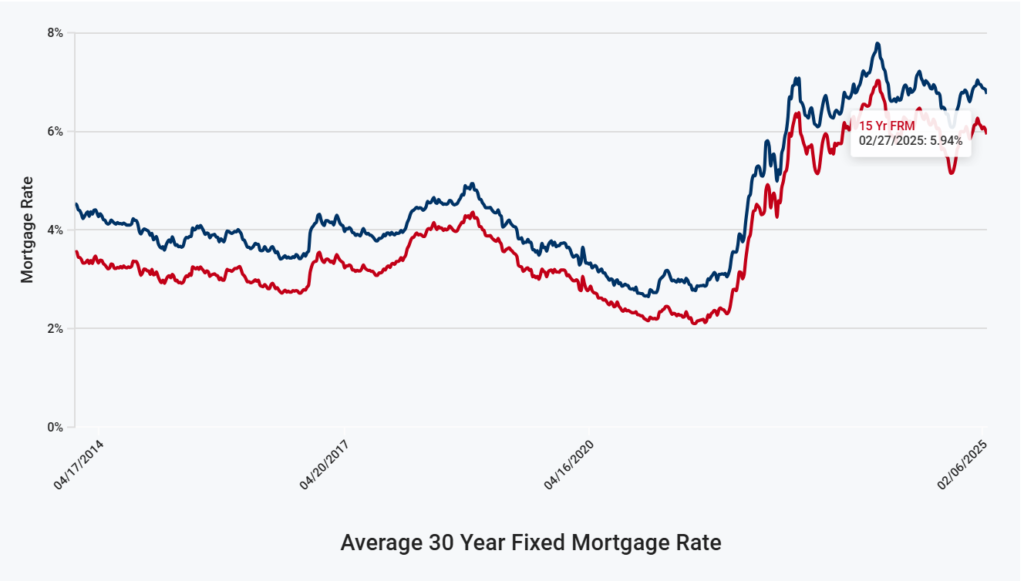

Freddie Mac’s latest Primary Mortgage Market Survey, released Thursday, showed that the average rate on the benchmark 30-year fixed mortgage decreased to 6.76% from last week’s reading of 6.85%. The average rate on a 30-year loan was 6.94% a year ago.

“The drop in mortgage rates, combined with modestly improving inventory, is an encouraging sign for consumers in the market to buy a home,” said Sam Khater, Freddie Mac’s chief economist.

The average rate on the 15-year fixed mortgage fell to 5.94% from 6.04% last week. One year ago, the rate on the 15-year fixed note averaged 6.26%.

Mortgage rates ranged from 6.91% to 7.04% in January, and the National Association of Realtors (NAR) said that in comparison to one year ago, the monthly mortgage payment on a $300,000 home increased by an extra $50 to $1,590.

A "sold" sign is seen outside a recently purchased home in Washington. (Reuters/Sarah Silbiger/File Photo / Reuters Photos)NAR reported on Thursday that its pending home sales index fell to the lowest level on record in January due to the double whammy of high mortgage rates and high home prices. Pending home sales were down 5.2% compared with a year ago.

“It is unclear if the coldest January in 25 years contributed to fewer buyers in the market, and if so, expect greater sales activity in the upcoming months,” said NAR chief economist Lawrence Yun. “However, it’s evident that elevated home prices and higher mortgages strained affordability.”

Associated Press, CBS News, Fox News, and preCharge News contributed to this report.

This is a developing news story. More information will be provided as soon as it becomes available.