For most people, buying a home represents their most substantial financial transaction and is widely regarded as a foundational step toward building wealth and increasing net worth. According to a CoreLogic report, U.S. homeowners with mortgages saw their net home equity exceed $17.6 trillion in the second quarter of 2024. This marks a $1.3 trillion increase in home equity over the same period last year, reflecting an 8% year-on-year growth.

Home equity, simply put, is the difference between a home’s market value and any remaining mortgage balance. Steven LaRosa, director and senior portfolio manager at Edgemoor Investment Advisors in Maryland, explains that equity doesn’t accumulate overnight. “At the start of homeownership, the loan is substantial, and initial equity is generally zero,” says LaRosa, whose firm is ranked 14th on the CNBC Financial Advisor 100 list.

Equity growth typically begins to materialize within five to 10 years, influenced by factors like down payments, loan terms, credit scores, and property appreciation rates. Homebuyers with a down payment immediately gain equity; for example, purchasing a $250,000 home with a $17,500 down payment results in $17,500 in instant equity, per Freddie Mac.

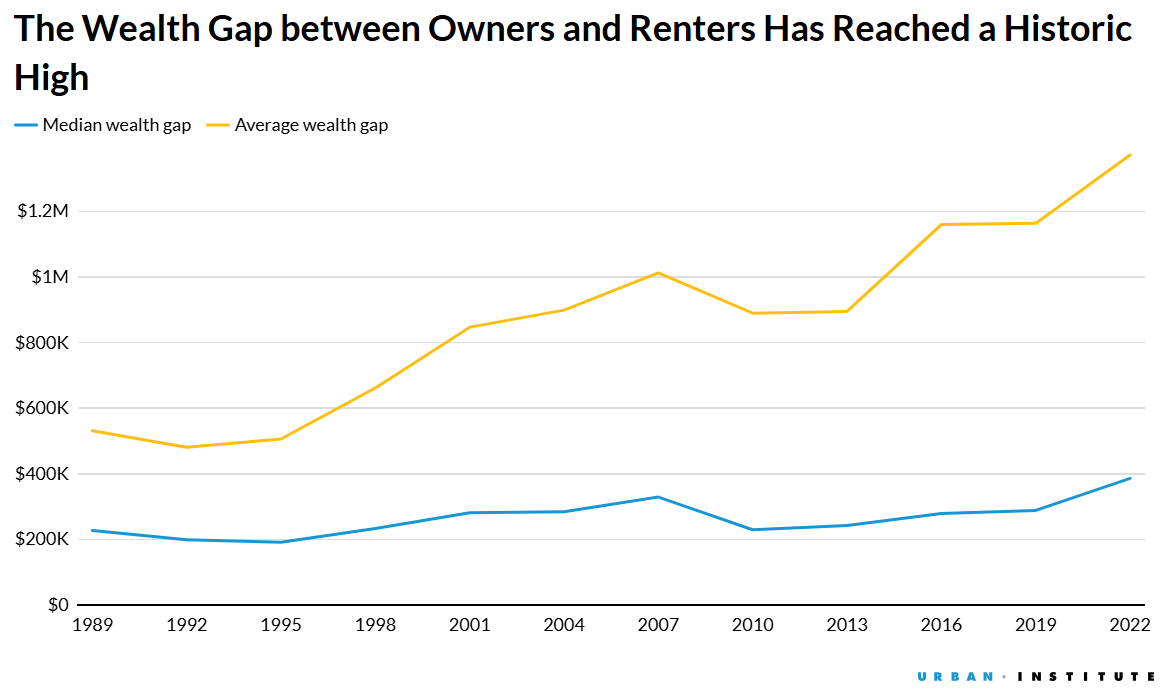

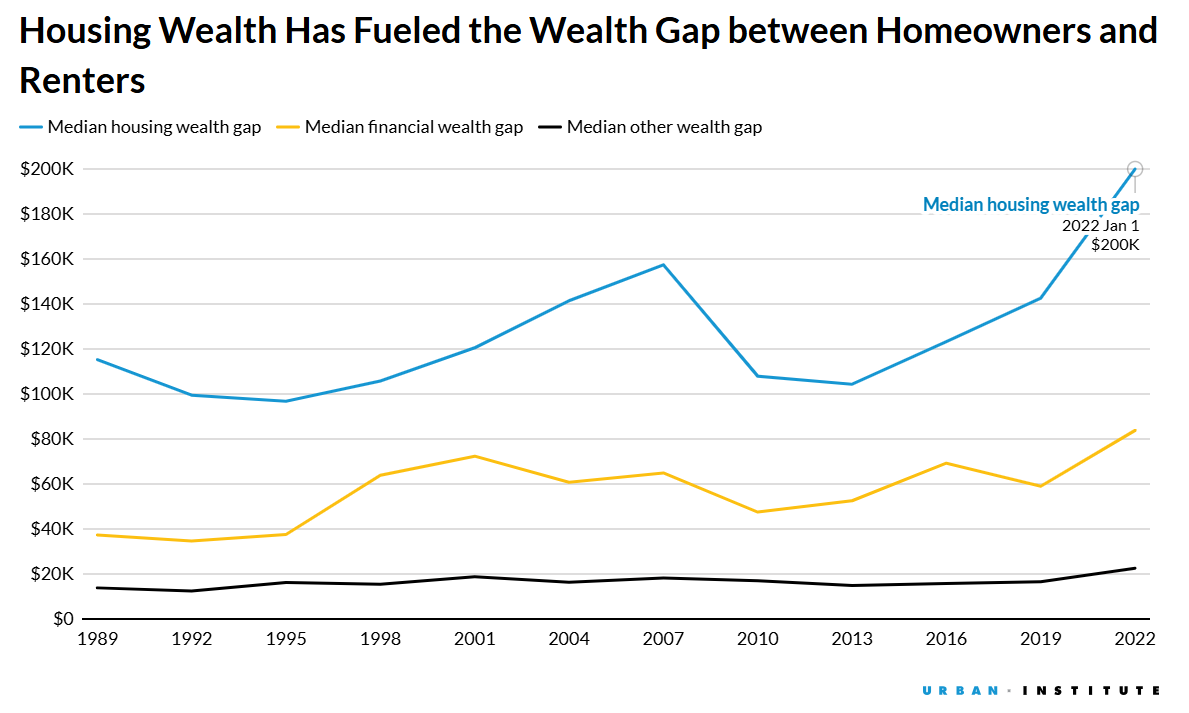

Homeownership can directly enhance net worth through mortgage payments that gradually reduce the principal, turning property into an appreciating asset over time. Unlike rent, which is a recurring expense, mortgage payments build forced savings that contribute to wealth accumulation. Over the past 33 years, the median wealth gap between homeowners and renters has surged by 70%, reaching a difference of $390,000, according to the Urban Institute.

For homeowners, each mortgage payment and home value increase contribute to net worth growth. “It’s a way to increase your net worth over time,” LaRosa said. “But initially, it’s a negative for your net worth, especially in the first year or two after purchase.”

Early Years of Homeownership: Financial Considerations

Consider a scenario where you buy a $250,000 home with a 20% down payment of $50,000. According to Stephen Cohn, co-founder and co-president of Sage Financial Group, your initial asset on the balance sheet reflects only that down payment amount—not the total home price. “The asset on your balance sheet is really the $50,000, not $250,000,” Cohn said.

This down payment becomes illiquid, making it harder to access. Additionally, early costs like closing fees and title insurance can negatively impact net worth due to their upfront expenses, according to Shaun Williams, a private wealth advisor and partner at Paragon Capital Management in Denver. Jeffrey Hanson, CFP at Traphagen Financial Group, agrees that initial payments may not generate equity for the first five to seven years.

“Building equity in the home through mortgage payments takes time,” Hanson notes, stressing the importance of understanding homeownership as a long-term investment for wealth creation.

As homeowners make steady mortgage payments, their equity accumulates, and net worth rises over time. By aligning expectations with financial goals, experts say homeowners can leverage property ownership as a powerful vehicle for long-term wealth generation.