China’s real estate market is facing a prolonged downturn, with recovery unlikely until late 2025, according to recent forecasts from Goldman Sachs, S&P Global Ratings, and Morgan Stanley. Despite the Chinese government’s latest stimulus measures aimed at stabilizing the struggling sector, analysts caution that any rebound may be modest and prolonged.

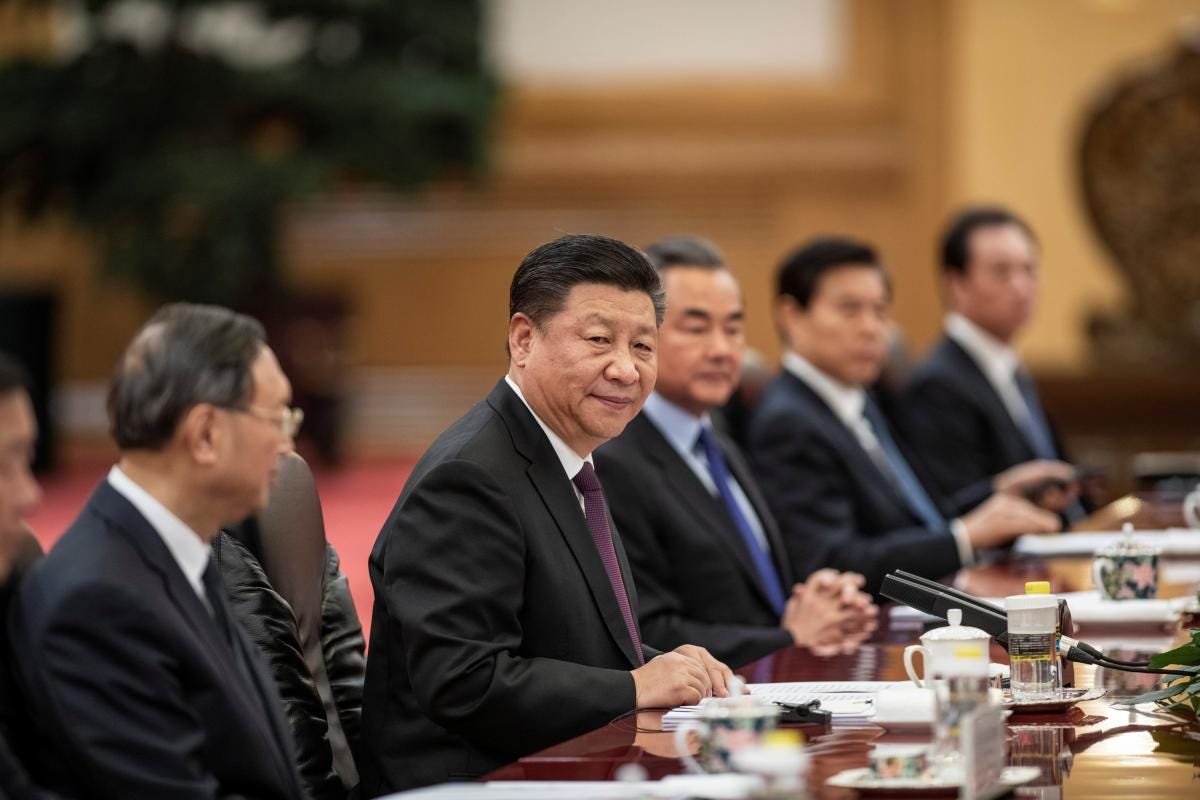

After a year of piecemeal interventions, Chinese President Xi Jinping convened a top-level meeting in late September to address the ongoing property market decline. Building on this, the Finance Ministry introduced a suite of new policies aimed at supporting the sector, and Goldman Sachs has declared the housing market may finally be at an inflection point.

Goldman analysts project that property prices will stabilize by late 2025, with a modest 2% average growth two years later. However, significant improvements in property sales and new construction may not materialize until 2027. S&P Global Ratings and Morgan Stanley similarly foresee market stabilization in the second half of 2025, emphasizing that the effects of policy changes may take time.

“If the government continues prioritizing developer financing and inventory reduction, property sales and prices could stabilize in late 2025,” Edward Chan, director at S&P Global Ratings, explained. Yet Beijing has clarified that boosting real estate is secondary to enhancing advanced manufacturing as a long-term growth driver. This priority shift is challenging since real estate has long been pivotal to China’s economy, previously accounting for over a quarter of its GDP and deeply tied to both household wealth and local government finances.

Stimulus Requirements and the Road Ahead

Goldman Sachs analysts estimate that the government may need to inject an additional 8 trillion yuan ($1.12 trillion) in fiscal spending to prevent a prolonged slump. Without such funding, they warn, the downturn could extend by another three years. Key priorities for any additional stimulus would include resolving liquidity issues, reducing unsold housing inventories, and ensuring the delivery of pre-sold but unfinished homes.

Pre-sales have traditionally been a standard model in China, where properties are sold before completion. This practice became unsustainable as Beijing cracked down on developers’ debt dependence and economic growth slowed. Last year, Nomura estimated that 20 million pre-sold homes remained incomplete. Although government programs have since facilitated the completion of around 4 million homes, millions more remain in limbo.

In fact, Morgan Stanley analysts projected that nearly 30% of unsold homes might never find buyers, placing the burden on banks or other entities to absorb these losses. However, China’s real estate sector showed slight improvement in recent weeks: property sales in major cities dropped just 4% year-over-year in October, a significant improvement from a 25% decline in September, according to the China Index Academy.

No Return to Real Estate’s Former Glory

Even if the market stabilizes, analysts caution that a return to the boom years is unlikely. S&P expects property sales to dip to 9 trillion yuan or lower this year, falling to 8 trillion yuan in 2025—less than half the sales volume from 2021’s peak. Inventory pressures are mounting, with developers increasingly resorting to price cuts to attract buyers and reduce stock.

According to S&P Global, sales by China’s top 100 developers dropped 37.7% year-over-year in September, marking the largest decline since April 2024. In the first nine months of the year, cumulative sales were down 36.6% compared to the previous year, further impacting developers’ liquidity and confidence. New construction projects plummeted by 42% from their 2019 peak, with an additional 23% decline year-over-year in early 2024.

Skepticism Persists Amid Limited Support Measures

Analysts remain cautious about the lasting effects of the Chinese government’s efforts to bolster the property market. Goldman Sachs warned that without further fiscal action, property values could drop another 20-25%. In May, the People’s Bank of China allocated 300 billion yuan for a relending program to support state-owned enterprises in buying unsold homes and converting them to affordable housing, but this measure addresses only 4-6% of the current housing surplus, according to S&P Global.

Morgan Stanley analysts highlighted that some banks in wealthier regions, such as Zhejiang, have yet to join the government program to extend loans for housing purchases, indicating that the impact of these measures is limited.

As analysts keep an eye on an upcoming parliamentary meeting for further fiscal guidance, the fate of China’s real estate sector remains uncertain. While new policies offer a lifeline, the road to recovery for China’s property market will likely be gradual, underscoring the need for ongoing support in a sector central to the country’s economic health.