Morgan Stanley has extended its use of OpenAI’s generative artificial intelligence technology to its high-stakes investment banking and trading division. Building on the success of its AI assistant for wealth advisors, launched in early 2023, the firm introduced a new version of the tool, dubbed AskResearchGPT, to its institutional securities group over the summer. Katy Huberty, Morgan Stanley’s global director of research, shared these details in an exclusive interview with CNBC.

AskResearchGPT allows employees to quickly search across Morgan Stanley’s vast repository of research on stocks, commodities, and industry trends, saving hours that might otherwise be spent navigating the over 70,000 reports the bank generates each year.

“This is a productivity game-changer for our research analysts and our institutional securities colleagues,” Huberty said. “The tool enables efficient access to high-quality, in-depth information.”

Wall Street Embraces AI

OpenAI’s technology, initially popularized by ChatGPT’s viral consumer launch in 2022, has seen rapid adoption among Wall Street’s largest institutions. Today, nearly half of Morgan Stanley’s 80,000 employees use generative AI tools powered by OpenAI, while at JPMorgan Chase, approximately 60% of its 316,000 employees are using AI tools based on OpenAI’s models, according to a source familiar with the matter. With OpenAI now valued at $157 billion, its early focus on financial applications has helped it become a dominant player in the sector, says Pierre Buhler, a banking consultant with SSA & Co.

“OpenAI has a distinct lead in market penetration,” Buhler said, noting that the industry is still in the early stages of AI implementation. “But competitors like Anthropic will likely gain traction over time as the technology matures.”

Increasing Efficiency with AskResearchGPT

Morgan Stanley’s staff have quickly embraced AskResearchGPT, using it instead of traditional channels like phone calls and emails to the research team. The tool has proven especially popular among sales and client-facing employees, who can now answer client questions with greater speed. According to Huberty, the tool has already led to a threefold increase in inquiries compared to a previous, traditional AI tool the bank deployed in 2017.

“We found that it takes salespeople one-tenth of the time to respond to the average client inquiry using AskResearchGPT,” said Huberty.

Boosting Productivity Across Operations

In a recent demonstration, the GPT-4-powered chatbot seamlessly summarized Morgan Stanley’s positions on topics ranging from copper prices to Nvidia’s tech trajectory. The tool understands industry-specific terminology and can produce charts, links, and summaries, saving employees valuable time.

With AskResearchGPT embedded directly into employee browsers, Microsoft Teams, and Outlook, Morgan Stanley is committed to maximizing adoption across its workforce.

Despite the efficiency boost, Huberty addresses the recurring question of whether AI could eventually replace human analysts. She asserts that while AI enhances productivity, it doesn’t replace the human expertise and relationship-building integral to roles in research, sales, and trading.

“I don’t see a path where the machine is solely writing research reports or generating ideas in the near future,” she said. “It’s still the human insight and client relationships that form the foundation of these roles.”

As Morgan Stanley and other financial giants invest in AI-driven solutions, generative AI is redefining the speed and accessibility of information on Wall Street. AskResearchGPT stands as a notable example of how AI can complement human expertise, offering productivity gains while reinforcing the importance of human judgment in the fast-paced world of finance.

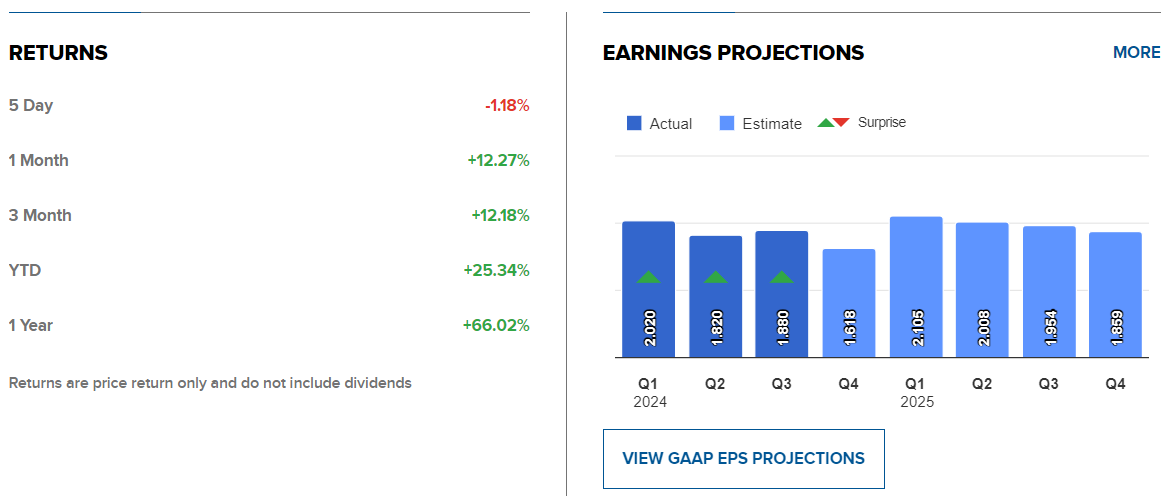

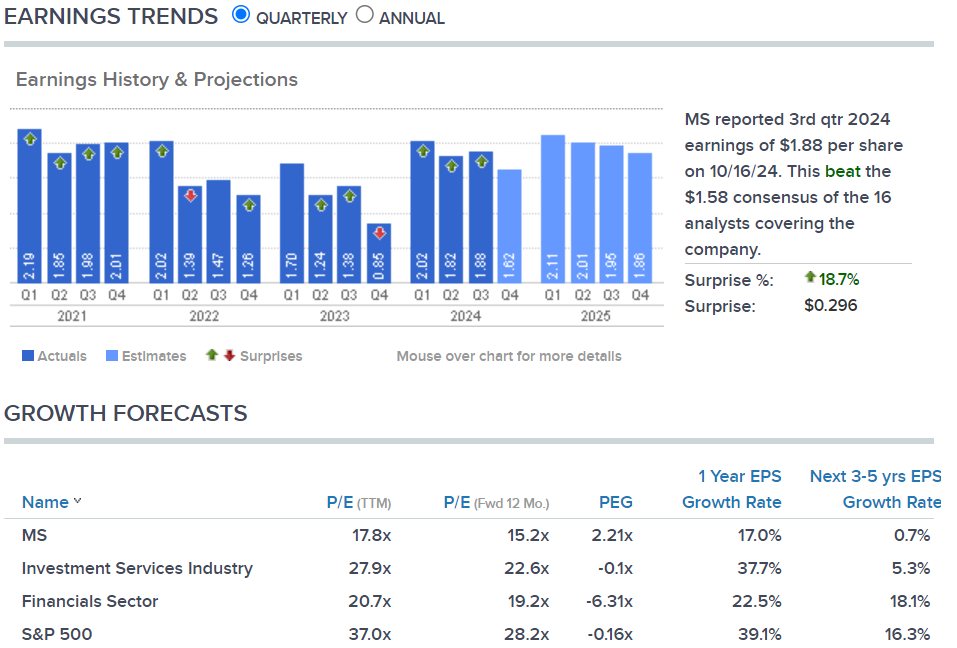

Morgan Stanley Stock Price and Analytics