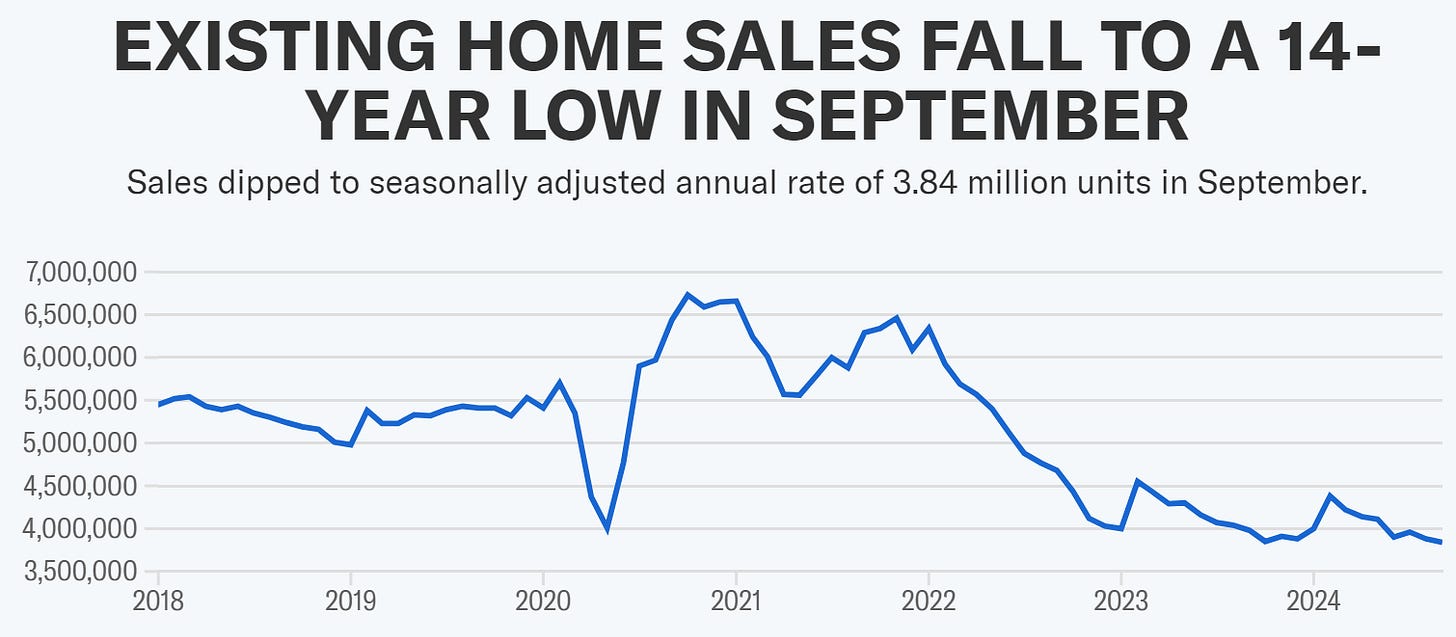

The U.S. housing market continued to slump in September, with sales of previously owned homes dropping to an annualized rate of 3.84 million units—the slowest pace seen since October 2010, according to the National Association of Realtors (NAR). The 1% month-over-month decline marks a stark 3.5% fall from a year ago, reflecting sustained high mortgage rates and limited inventory, especially in all regions except the West.

September’s slowdown is based on home sales closings, which primarily represent contracts signed in July and August, during which mortgage rates hovered close to 7% for 30-year fixed loans. Although rates dipped slightly through August, they remain more than a full percentage point higher than a year ago.

“Home sales have been stuck around the four-million-unit pace over the past year,” said Lawrence Yun, NAR’s chief economist. “However, there are factors in place that would typically support higher sales levels,” he added, pointing to slowly increasing inventory and strong consumer interest.

Inventory and Pricing Trends

Inventory rose by 1.5% in September, bringing the total to 1.39 million homes available, or a 4.3-month supply at the current sales pace. Year over year, inventory was up by 23%, though it still falls short of demand in many areas. According to Yun, the rising supply offers more options for buyers but remains below pre-pandemic levels.

Distressed property sales, which often boost housing supply, have had a minimal impact. The mortgage delinquency rate remains low, and distressed properties accounted for just 2% of all transactions in September, indicating limited availability of discounted properties.

The median price of an existing home edged up 3% year-over-year to $404,500, marking the 15th consecutive month of price increases. Rising prices, coupled with high interest rates, continue to hinder affordability for many buyers, especially first-timers who comprised only 26% of September sales—the same as the all-time low in August.

Cash Purchases Dominate as Homes Linger on Market

Cash purchases, which have surged post-COVID, accounted for 30% of all sales in September, compared to 20% in pre-pandemic years. Although investor participation dropped slightly to 16% of sales from 19% in August, cash continues to play a significant role, underscoring the market’s shift away from financing-dependent buyers.

Homes are staying on the market longer as well, averaging 28 days before selling compared to 21 days a year ago. The slowdown suggests many buyers are exercising caution in the face of high interest rates and rising prices, while others remain on the sidelines, unable to enter a market where affordability is increasingly out of reach.

Outlook: Challenges Persist as Buyers Face Limited Options

While a slight increase in inventory offers some relief, overall home sales are likely to remain subdued unless mortgage rates fall and more affordable housing options come to market. As Yun notes, “More inventory is certainly good news for buyers,” but with only minimal distressed property options and cash dominating transactions, affordability challenges continue to shape the real estate landscape heading into the final quarter of 2024.