Trump Media shares faced multiple trading halts Tuesday morning due to intense volatility, as shares surged on the Nasdaq under ticker DJT. Majority-owned by Donald Trump, the media stock saw a series of trading pauses shortly after the opening bell, following a Monday rally that pushed shares up over 21%.

The initial halt occurred at 9:36 a.m. ET when shares climbed approximately 14%, while another pause followed at 9:42 a.m., with prices up nearly 9%. A third halt came at 9:50 a.m. as nearly 16 million shares changed hands in just the first 10 minutes of the trading day.

The volatility follows a dramatic increase in Trump Media’s stock price over the last month, which began with a recovery in late September after a prolonged sell-off dropped the share price below $12. Now, just weeks later, DJT shares are trading more than four times that previous low, up 224% for October alone, setting the stage for the stock’s best month since October 2021.

The current rally has surged DJT shares to levels not seen since mid-July, when the stock spiked following a narrowly thwarted assassination attempt on the Republican presidential candidate. Trump, who owns approximately 57% of Trump Media, has seen his stake rise in value from $5.4 billion at Monday’s close to over $6 billion by Tuesday’s opening bell, according to estimates by Forbes.

Behind the Rally: Political Momentum and Retail Investor Loyalty

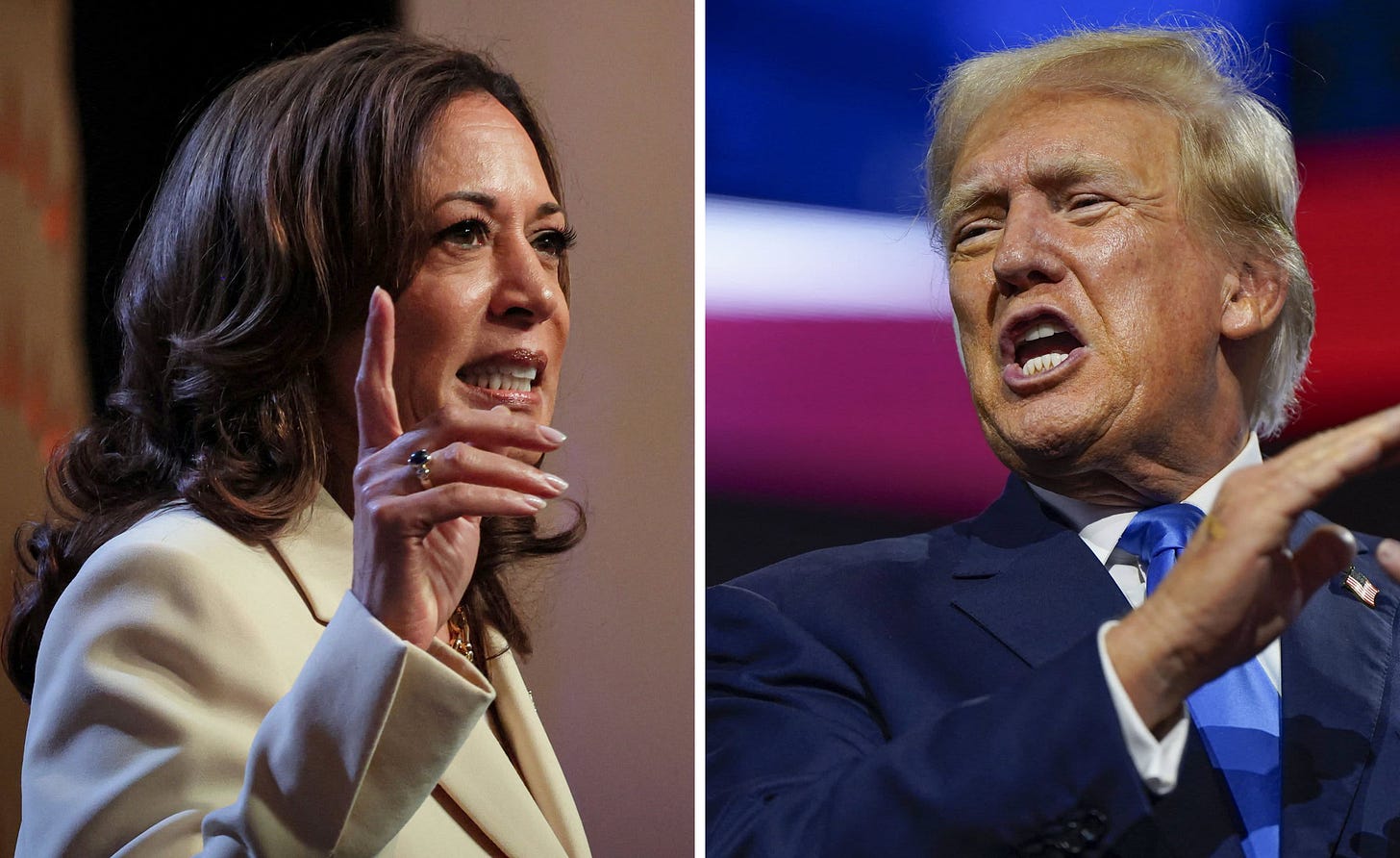

Analysts attribute the sharp DJT rally largely to pro-Trump retail investors, who are heavily invested in the stock as a show of support and a bet on Trump’s odds against Democratic opponent Kamala Harris in the upcoming presidential election. Monday’s surge followed a campaign rally at Madison Square Garden, signaling a boost in momentum among Trump supporters.

Interestingly, the stock’s performance also reflects shifts in political betting markets, where Trump has recently gained an edge over Harris. Platforms like Polymarket and Kalshi show bettors increasingly favoring Trump over his Democratic rival, although these prediction markets differ from traditional polling methodologies. Some critics suggest that the uptick in betting markets could be manipulated, raising questions about reliability.

Outlook for Trump Media

Despite the company’s struggle with revenue losses in recent fiscal quarters, Trump Media’s market cap has crossed the $10 billion threshold, fueled by a loyal investor base and high trading volume. The volatility comes as Trump’s media platform, Truth Social, continues to attract attention in the conservative media landscape.

This pre-election surge highlights the company’s unique position at the intersection of politics and media investment. While traditional analysts might caution against the stock’s volatility, its appeal to retail investors eager to support Trump appears undeterred. As election season heats up, Trump Media remains one of the most closely watched stocks, with more potential market swings anticipated as political events continue to influence investor sentiment.