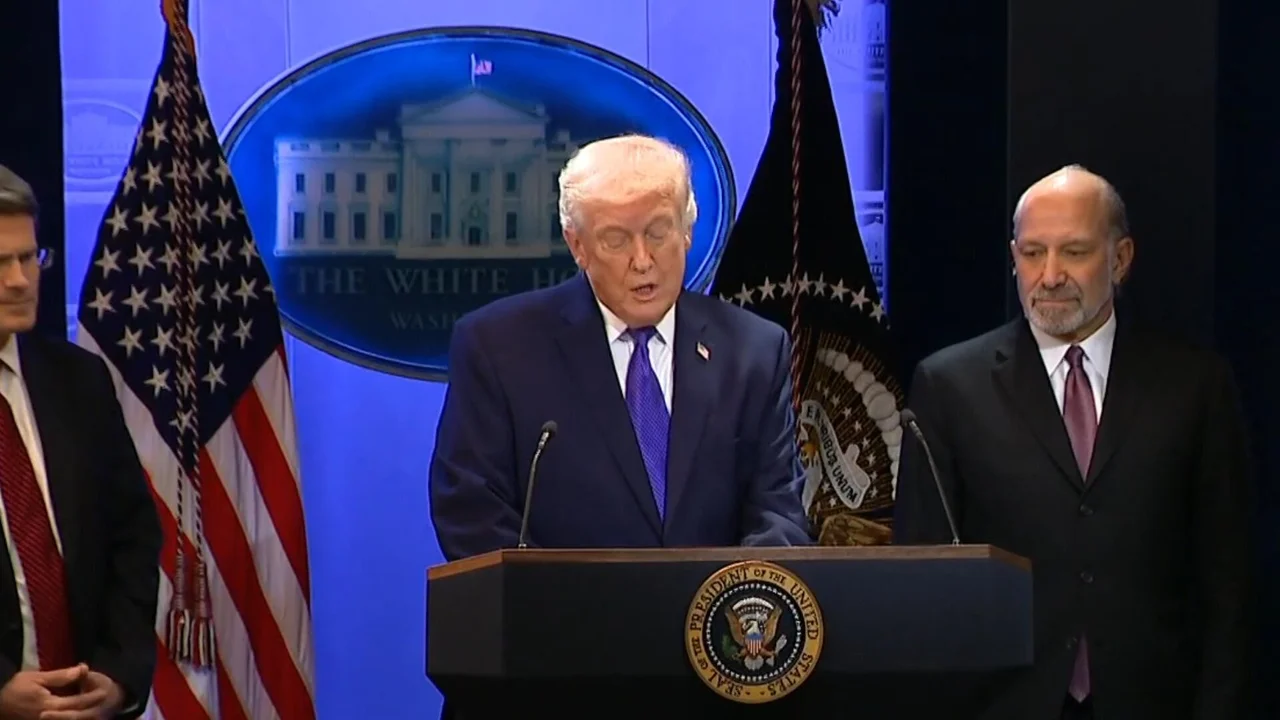

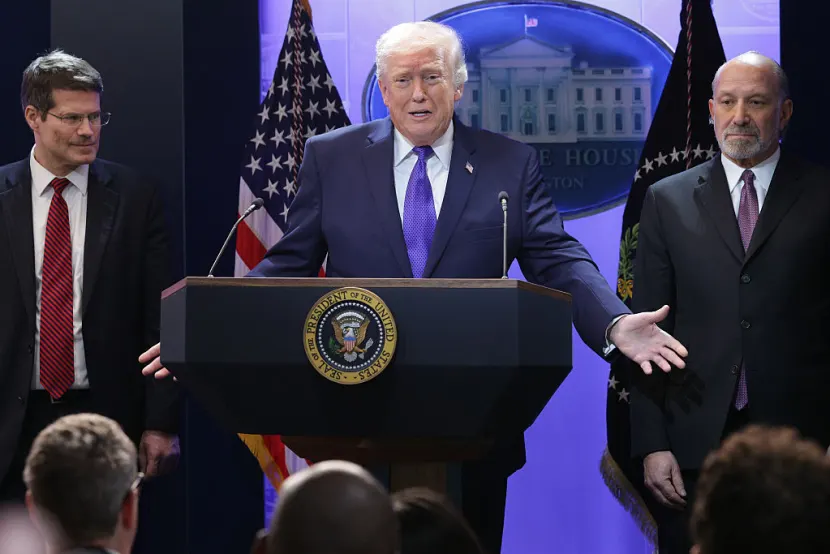

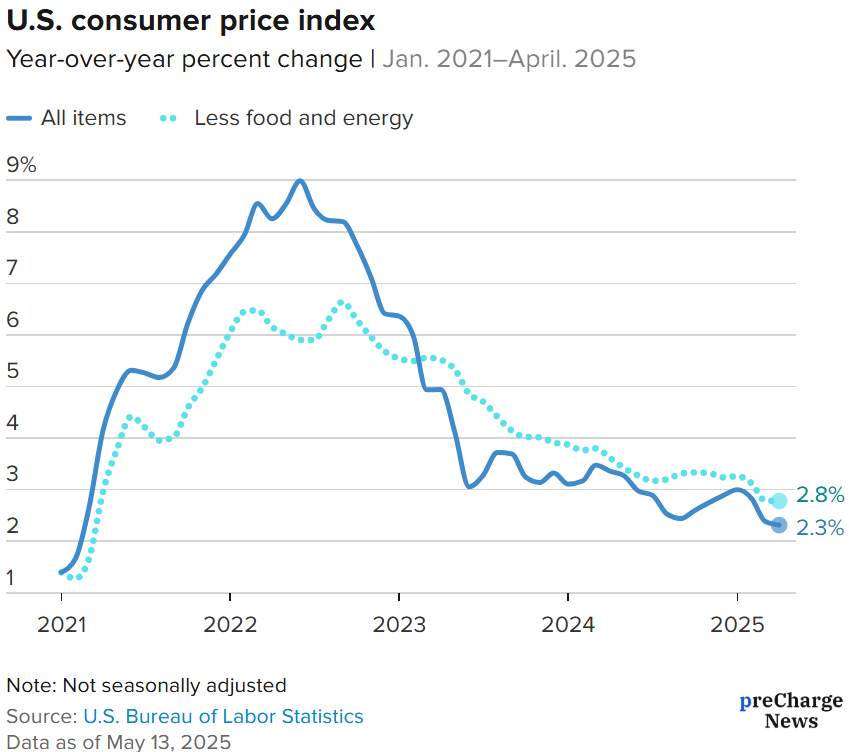

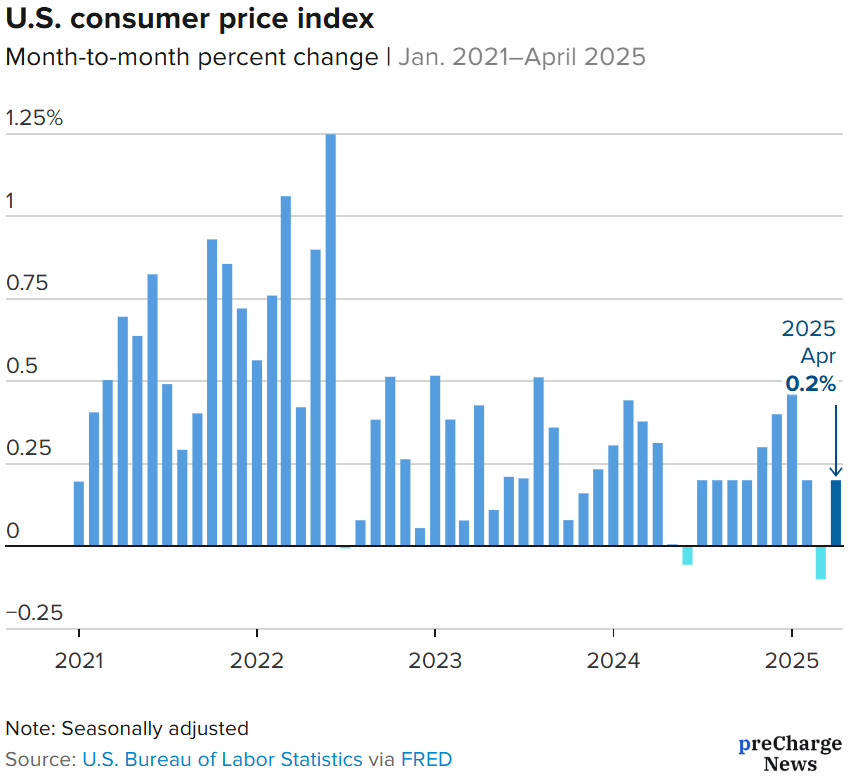

preCharge News BUSINESS — U.S. inflation cooled in April, coming in slightly below expectations as President Donald Trump’s tariffs on imports began to ripple through the slowing economy. According to a Labor Department report released Tuesday, the Consumer Price Index (CPI) rose 0.2% for the month, placing the 12-month inflation rate at 2.3%, its lowest since February 2021.

Source: U.S. Bureau of Labor Statistics

Data as of May 13, 2025

Shelter Costs Drive Price Increases

The Bureau of Labor Statistics (BLS) noted that the monthly CPI reading matched the Dow Jones consensus estimate, while the year-over-year figure came in just below the forecast of 2.4%. Excluding volatile food and energy components, the core CPI also climbed 0.2% for the month, with a 2.8% annual rise, in line with expectations.

Shelter costs, which account for roughly a third of the CPI, remained the biggest contributor to the monthly gain. They rose 0.3% in April, accounting for over half of the overall increase, according to the BLS.

Source: U.S. Bureau of Labor Statistics via FRED

Data as of May 13, 2025

Energy and Food Prices Remain Mixed

After falling 2.4% in March, energy prices rebounded in April, posting a 0.7% increase. Meanwhile, food prices slipped 0.1%, reflecting ongoing supply chain disruptions and changing consumer habits.

Egg prices stood out with a dramatic 12.7% monthly drop, though they remain 49.3% higher than a year ago. Used vehicle prices fell 0.5% for the second straight month, while new car prices remained flat. Apparel costs dipped 0.2%, while medical care services rose 0.5%.

Tariff Impact Looms as Trade Talks Continue

The impact of Trump’s tariffs remains a wildcard for the inflation outlook. Earlier this year, the president announced a 10% duty on all U.S. imports as part of his “liberation day” push to rebalance trade. While he recently eased this stance, granting a 90-day reprieve for Chinese imports, the long-term effects on inflation remain uncertain.

Robert Frick, corporate economist at Navy Federal Credit Union, noted that many importers may still be absorbing their tariff costs, which could delay inflationary pressures. “Good news on inflation, and we need it given inflation shocks from tariffs are on their way,” Frick said.

Market Reaction and Fed Rate Outlook

Markets reacted cautiously to the CPI report, with stock futures trading flat to slightly lower and Treasury yields mixed. Despite the relatively tame inflation data, many traders remain wary of potential interest rate cuts from the Federal Reserve later this year.

The Fed relies more heavily on the Personal Consumption Expenditures (PCE) index for policy decisions, though the CPI remains an important part of its inflation analysis. The BLS will release its April producer price index (PPI) on Thursday, which is seen as a leading indicator for broader inflation trends.